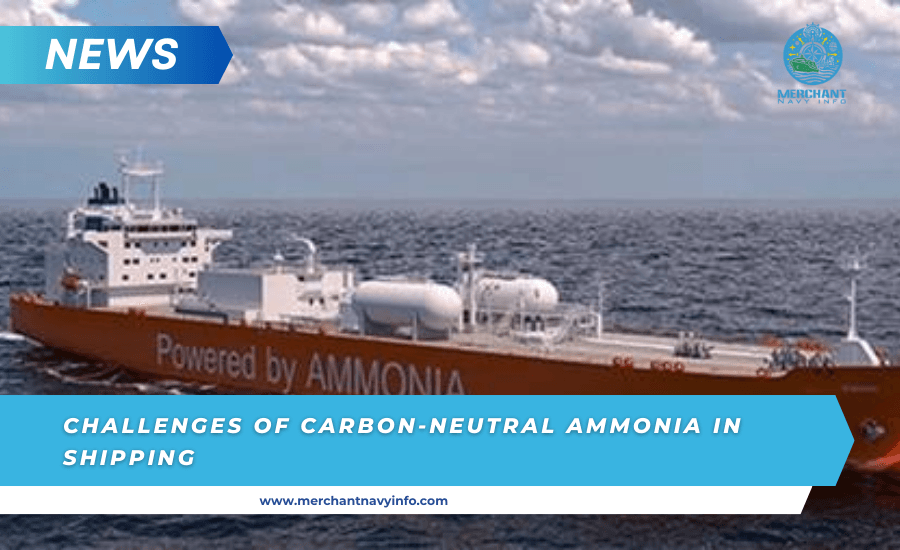

Carbon-Neutral Ammonia For Shipping Faces Cost And Safety Challenges

Last month, shippers safely completed the first ship-to-ship transfer of ammonia at one of the world’s largest bulk export ports in Western Australia, a key test of the clean energy push for ammonia as a marine fuel.

The first ammonia-powered cargo ships are due to enter service in 2026. This is one of several alternatives the industry is exploring to reduce its carbon footprint, which accounts for nearly 3% of global emissions.

However, compared with liquefied natural gas, methanol, and biofuels, ammonia faces significant cost and safety hurdles as a shipping fuel.

It is attractive because it has no carbon emissions and, if made from hydrogen produced from renewable electricity, would be a zero-emission fuel. However, safety is a major challenge for the product, commonly used in fertilizers and explosives.

“Currently, lack of regulation, experience with ammonia on ships and toxicity are the main safety barriers,” said Laure Baratgin, director of commercial operations at mining giant Rio Tinto.

Rio Tinto, the world’s largest iron ore producer, is the largest exporter at Dampier, where the ammonia transport trials occur. The company operates large dual-fuel ships powered by conventional marine fuel or LNG but has not chartered or ordered an ammonia-fueled ship.

“Until we and our partners, the industry and the community have confidence that the risks are adequately managed, we will seek to charter dual-fuel ammonia ships, but the timing remains uncertain,” he told Reuters.

Other operators are also hesitant. By 2024, only 25 ammonia dual-fuel ships had been ordered worldwide, while there were at least 722 LNG-fueled ships and 62 methanol-fueled ships in the fleet, including ships on order and already in operation.

Currently, only two small ammonia-powered ships are in service, one of which is a tugboat in Japan.

Hazardous properties

Bunkering poses particular challenges for ammonia, which can cause severe poisoning and damage to the skin, eyes and respiratory system.

“The biggest risk is spills during bunkering operations” and leaks from tanks said Yoshikazu Uroshitani, general manager of Mitsui OSK Lines 9104.T’s marine fuels division. The company is designing an ammonia-powered bulk carrier.

A pilot study by Singapore’s Global Centre for Maritime Decarbonisation (GCMD) identified 400 risks associated with local ammonia sources.

He said that if a leak is detected, measures such as emergency connection shut-off systems can mitigate the risk.

The centre is developing detailed contingency plans for ammonia leaks, which are harder to contain than oil leaks.

“With oil, you see it stays there and disperses into the water, but ammonia dissipates into the air,” said Lu Lin, executive director of GCMD.

Nippon Yusen Kabushiki Kaisha (NYK) has agreed to build the first medium-sized ammonia-fuelled cargo ship and has developed dedicated ammonia bunkering equipment.

Takahiro Rokuroda, general manager of NYK’s next-generation fuel business group, said the industry must develop guidelines for seafarers to manage the fuel safely.

Singapore, the world’s largest bunkering hub, has selected companies to study the feasibility of ammonia for power generation and bunkering, and is developing ammonia bunkering standards.

High cost

For ammonia to be competitive in the fuel space, costs must fall dramatically.

Industry data suggests that ships running on ammonia can cost two to four times more than conventional fuels due to its limited supply in the maritime sector and its energy density of about 2.5 times lower.

“If you want to travel the same distance, you have to carry about 2.5 times more fuel, or you have to refuel more frequently until you have enough fuel to be able to complete the trip,” Lu said.

Ammonia engines also require extra maintenance because the fuel causes corrosion, according to engine maker Wärtsilä.

However, the American Bureau of Shipping expects ammonia to account for about a third of marine fuel supplies by 2050.

“We certainly won’t bring anything to market until we are 100% confident that all the risks are properly managed,” said Kenny McLean, chief operating officer of marine fuel supplier Peninsula.