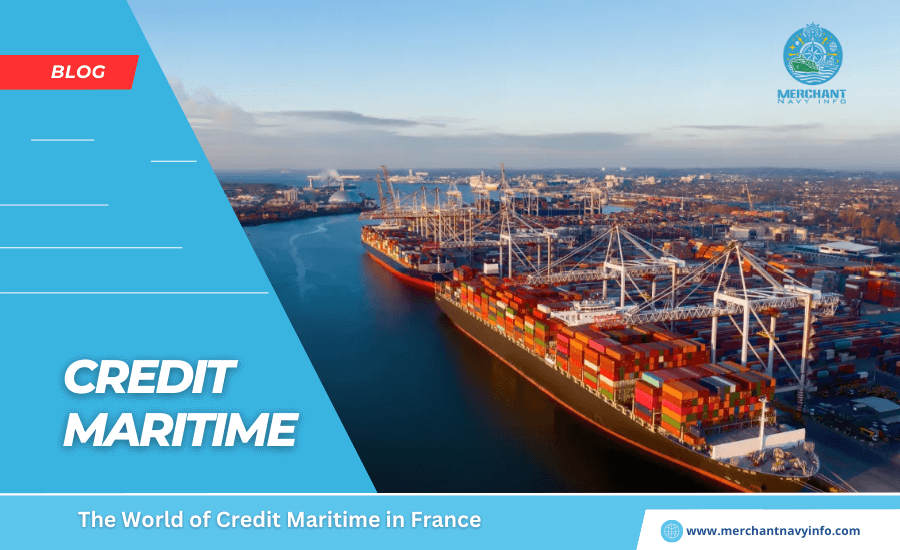

The vast expanse of the ocean not only facilitates global trade but also fuels a diverse and dynamic economic ecosystem. Within this ecosystem lies Credit Maritime, a prominent French banking group serving as a vital financial partner for the maritime and coastal economy. This comprehensive guide delves into the history, operations, and services offered by Credit Maritime, highlighting its significance in propelling the maritime industry forward.

A Voyage Through Time: The Origins and Evolution of Credit Maritime

Established in 1906, Credit Maritime boasts a rich legacy spanning over a century. Born from the need to support the burgeoning maritime activities in France, it was initially established as a cooperative bank specifically catering to the financial needs of fishermen and coastal communities. Over time, recognizing the evolving landscape of the maritime industry, Credit Maritime strategically expanded its reach, becoming a universal bank offering a comprehensive suite of financial services.

Aligning with a Powerful Partner: The Integration with Groupe BPCE

In 2003, Credit Maritime embarked on a significant chapter by joining forces with Groupe BPCE, a leading French banking group. This strategic alliance allowed to leverage the extensive resources and expertise of Groupe BPCE, further solidifying its position as a key player in the maritime financial landscape.

Charting the Course: Core Values and Mission

Credit Maritime operates with a set of core values that guide its operations and philosophy:

- Customer Focus: Placing the needs of its clients at the forefront, Credit Maritime strives to build strong relationships and deliver personalized solutions.

- Innovation: Continuously seeking new and innovative ways to support the maritime industry, the bank actively explores and embraces technological advancements.

- Sustainability: Recognizing the growing importance of environmental responsibility, Credit Maritime integrates sustainability principles into its business practices and supports initiatives that promote a sustainable maritime future.

- Local Presence: Maintaining a strong local presence throughout France, Credit Maritime ensures that it remains deeply connected to the communities it serves and understands their unique needs.

With this foundation of values, Credit Maritime’s mission is clear: to act as a reliable and innovative financial partner, fostering the growth and development of the maritime and coastal economy across France and beyond.

Exploring the Landscape: Key Areas of Specialization

Credit Maritime’s expertise lies in providing financial solutions tailored to various segments of the maritime and coastal economy. These segments can be broadly categorized as:

- Maritime Transportation: This encompasses financing for various aspects of ship operations, including shipbuilding, ship financing, ship repairs, and freight forwarding.

- Fisheries and Aquaculture: Credit Maritime supports the fishing and aquaculture industry by offering loans and financing for vessel acquisition, equipment upgrades, and operational activities.

- Ports and Logistics: The bank finances infrastructure development, expansion projects, and equipment acquisition for ports and logistics companies.

- Maritime Tourism and Leisure: This segment includes financing for activities like cruise ship operations, marinas, and yachting.

In the next part of this guide, we’ll explore Credit Maritime’s specific services. Also how they cater to the diverse needs of the maritime and coastal economy. We’ll also examine the bank’s commitment to sustainability and its role in promoting a responsible maritime future.

Part 1 of this guide explored the history, core values, and areas of specialization of Credit Maritime. Now, let’s delve deeper into the specific services offered by the bank and its commitment to sustainability.

A Comprehensive Suite of Financial Solutions

Credit Maritime provides a broad spectrum of financial services designed to address the diverse needs of its clients within the maritime and coastal economy. Here are some key offerings:

- Loan and Financing Solutions:

- Ship financing: Structured financial solutions for acquiring, constructing, and refinancing various types of vessels, from commercial ships to cruise liners.

- Working capital financing: Supporting clients’ day-to-day operations by providing funding for operational expenses, fuel purchases, and crew wages.

- Investment financing: Facilitating investments in infrastructure development, equipment upgrades, and technological advancements for maritime businesses.

- Specialized Services:

- Project finance: Tailored financing solutions for complex maritime projects like port development, shipyard expansions. Also renewable energy initiatives in the coastal environment.

- Trade finance: Provide services like letters of credit, documentary collections, and foreign exchange solutions to assist clients with international trade transactions.

- Insurance brokerage: Offering access to competitive insurance products to protect clients against various maritime risks. Including hull and machinery insurance, cargo insurance, and liability insurance.

- Advisory Services:

- Market analysis and feasibility studies: Providing valuable insights into market trends, competitor analysis, and feasibility assessments for maritime businesses considering new investments or ventures.

- Risk management consulting: Assisting clients in identifying and mitigating risks associated with their operations. Including financial risks, operational risks, and environmental risks.

- Mergers and acquisitions (M&A) advisory: Supporting clients in navigating the complexities of mergers, acquisitions, and divestitures within the maritime sector.

Additionally, Credit Maritime offers dedicated services for specific client segments:

- Retail Banking: Tailored banking services for individuals working within the maritime sector, including specialized accounts, loans, and insurance products.

- Private Banking: Personalized wealth management solutions for high-net-worth individuals involved in the maritime industry.

Steering Towards a Sustainable Future

Credit Maritime recognizes the critical role it plays in promoting a sustainable maritime future. The bank integrates environmental considerations into its business practices through various initiatives:

Financing sustainable projects:

Fostering projects that promote sustainable practices, such as fuel-efficient ships, clean technologies in port operations, and sustainable aquaculture.

Green loan offerings

We are providing preferential loan terms to clients who invest in environmentally responsible projects or adopt sustainable technologies.

Partnerships with green organizations

Collaborating with organizations dedicated to promoting environmental responsibility in the maritime industry, such as the World Wildlife Fund (WWF) and the International Maritime Organization (IMO).

By combining financial expertise with a commitment to sustainability, Credit Maritime strives to ensure the long-term viability and environmental responsibility of the maritime and coastal economy.

In the final part of this guide, we’ll explore Credit Maritime’s global reach, its network of branches and partnerships, and its commitment to supporting various maritime organizations. We’ll also provide some resources for individuals and businesses seeking to learn more about Credit Maritime and its services.

Parts 1 and 2 of this guide delved into the history, core values, areas of specialization, and commitment to sustainability of Credit Maritime. Now, let’s explore its global reach, network, and resources.

Expanding Horizons: Credit Maritime’s Global Footprint

Credit Maritime, while deeply rooted in France, isn’t confined by its national borders. The bank boasts a global presence, extending its reach across continents to support maritime activities worldwide. Here’s how it operates internationally:

- International Network: Credit Maritime maintains a network of branches and representative offices in key maritime hubs worldwide, including:

- London, United Kingdom

- New York, United States

- Singapore

- Hong Kong

- Tokyo, Japan

- Strategic Partnerships: The bank has forged strategic partnerships with local and international financial institutions to offer comprehensive solutions to its clients operating across diverse geographical locations.

- Cross-Border Expertise: Credit Maritime’s team possesses expertise in cross-border financing and trade finance, enabling them to facilitate transactions involving clients and assets situated in different countries.

This global reach allows Credit Maritime to cater to the needs of international maritime businesses and act as a bridge between different maritime markets.

Building a Strong Network: Collaborations and Partnerships

Credit Maritime recognizes the importance of collaboration in fostering a healthy and sustainable maritime ecosystem. The bank actively participates in and supports various maritime organizations, including:

- Industry Associations: Credit Maritime is a member of numerous industry associations, such as the International Chamber of Shipping (ICS), the European Community Shipowners’ Associations (ECSA), and the Association of French Shipowners (ARM). These memberships allow the bank to stay informed about industry trends, advocate for policies that support the maritime sector, and contribute to the development of best practices.

- Non-Profit Organizations: The bank also collaborates with non-profit organizations like the World Maritime University (WMU) and the Oceanographic Institute of Monaco. These partnerships contribute to research and development initiatives, educational programs, and efforts to preserve the marine environment.

Resources for Exploration and Engagement

If you’re interested in learning more about Credit Maritime or exploring its services, here are some valuable resources:

- Official Website: https://www.banquepopulaire.fr/cmgo/ (Available in French and English)

- Social Media: Follow Credit Maritime on social media platforms like LinkedIn and Twitter. To stay updated on the bank’s latest news, events, and initiatives.

- Contact Information: Credit Maritime provides contact information for its branches and representative offices worldwide, allowing you to connect with the bank directly.

Conclusion

Credit Maritime’s journey, spanning over a century. It reflects its unwavering commitment to supporting the growth, innovation, and sustainability of the maritime and coastal economy. By combining its financial expertise with a global reach and dedication to environmental responsibility. Also, continues to serve as a trusted partner for diverse stakeholders within the maritime landscape. As the maritime industry navigates the challenges and opportunities of the future. Credit Maritime is well-positioned to play a vital role in its continued development and a sustainable future for our oceans.