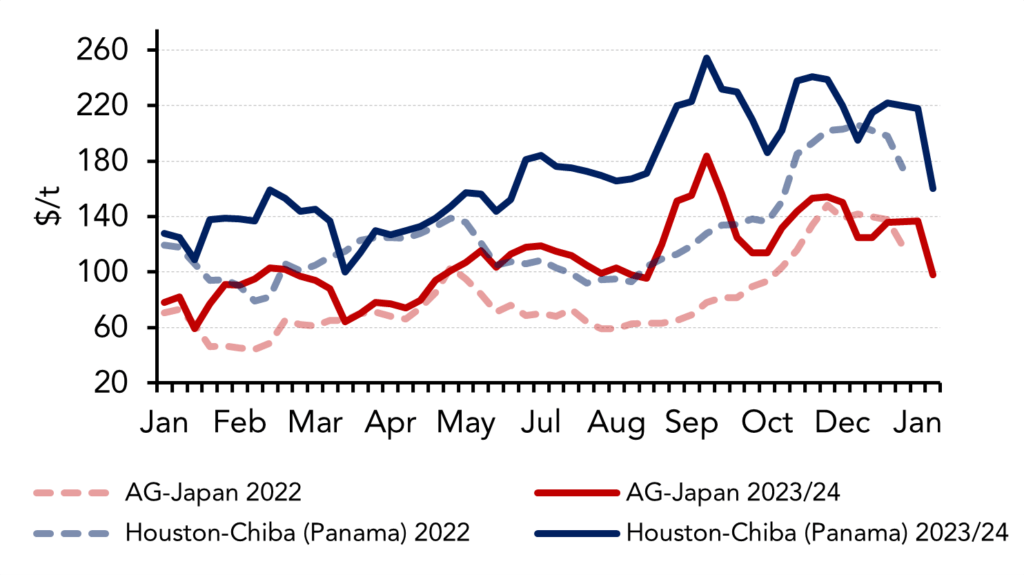

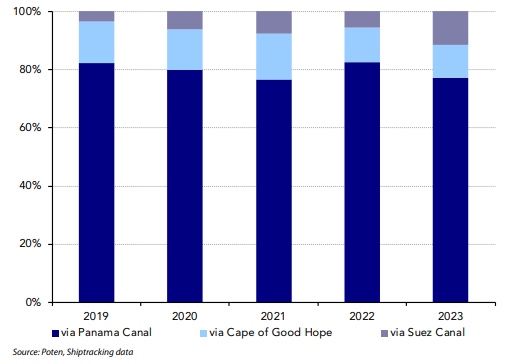

A number of ships, including large gas carriers (VLGCs). Have been avoiding the Suez Canal as several vessels were reportedly attacked by Iranian-backed Houthi boats. While navigating through the canal in December. This has brought further uncertainty to the shipping sector since mid-2011. Towards the end of December, a container ship sent out distress. Calls twice after being hit by a projectile one day and also then by four small boats attempting to board the ship the next day. A multinational naval coalition provides protection, but reports of attempted attacks and kidnappings are received daily. For this reason, many VLGCs choose to return to the U.S. Gulf Coast from the Far East around the Cape of Good Hope (COGH) rather than via the Suez Canal. If LPG bypasses the COGH instead of the Suez Canal. It may take an additional 4-7 days to reach the USGC.

This further exacerbated a cargo market already constrained by Panama Canal restrictions. VLGC freight rates have been on a downward trend since mid-November. But compared to $195/ton before the Suez Canal disruption in early January. Freight rates for VLGC freight from Houston to Chiba via Panama increased. The price on the route to which they were heading was around $220/ton, but the price has reversed. During this period, prices from Last Tanura to Chiba increased by about $10/tonne to $135/tonne.

Weekly Spot VLGC

Price Meanwhile, CFR Far East propane prices have been on a downward trend since the beginning of the year. And arbitrage between the U.S. and the Far East has narrowed significantly. Traders are refraining from buying spot cargo from the United States. VLGC spot prices fell sharply in the second week of January, dropping to $160 per tonne for the Houston-Chiba route via Panama. Some market participants expressed pessimism about freight rates due to stricter ARB rules and lack of trading.

US VLGCs up on east Suez relief

Far East propane prices rose despite disruptions in Panama and Suez. With weak demand from the petrochemical sector and some VLGCs able to secure southbound. No sharp increase was observed, reflecting both of these factors. Slot costs have been relatively low in recent weeks, suggesting that supply will be plentiful in the region in the coming months. Meanwhile, weak petrochemical margins and continued disruption may limit consumption in the petrochemical sector. Additionally, Iran’s LPG exports are estimated at approximately 9.5 million tons and are expected to increase further in 2024. Due to increased production at gas plants, which may also limit increased imports from the United States.

The overall utilization rate of China’s PDHs has been around 60% in recent weeks and is expected to remain at this level until February. Traditionally, manufacturing activity in China slows down for several weeks around the Lunar New Year. This year’s New Year will be celebrated from February 10 to 17. This should also maintain the country’s demand and supply balance in the first quarter of 2024. It remains unclear whether the fall in propane prices in the Far East will increase the appetite for PDH purchases. The earthquake in Japan affected areas that are largely unconnected to the city gas network and typically use LPG for winter heating. It is expected that winter demand may be lower than normal in these regions.

However

Ever since the Panama Canal reduced the number of transportation options available, more and more exports from the United States have gone to northwestern Europe. With the ongoing drought in the Panama Canal and current disruptions in the Red Sea, this trend is expected to continue. As a result, supplies are expected to be sufficient in Europe and the Mediterranean over the coming months, with some recovery expected in LPG intake from mixed feed crackers in the region, which declined significantly month-on-month in November. According to OPIS, LPG intake from mixed crackers increased by 145% month-on-month in December to an estimated 420,000 tonnes.

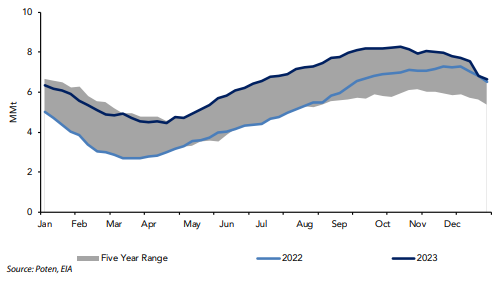

Us Weekly Propane/Propylene Storage

The propane-naphtha spread averaged approximately -$134/ton in November and -$136/ton in December, and futures prices indicate that the spread will be. This suggests that it will continue to expand through the third quarter and is expected to remain significantly higher than that. 100/ton will fall below $100/ton in Q4 2024, but it will still be cheap. Six million barrels at the end of 2023, an increase of only 2% from the previous year. Propane inventories at the beginning of Q4 2023 were up 20% year over year.

For the week ending December 22, the market saw an unexpected 9 million barrel reduction in inventories as exports were strong and domestic demand was lower than normal. However, EIA said that propane/propylene stocks in PADD 2 were overstated in publications from November 15, 2023, to December 20, 2023. The sharp decline is due to necessary adjustments. The sharp decline has not provided much support for Mont Belvieu prices, and arbitrage against U.S. exports remains. However, U.S. export growth in 2024 will be lower than previous projections made based on high inventories and limited excess export terminal capacity.