Tensions in the Middle East escalated this weekend as Iran carried out a response attack on Israel. While it feels difficult to do so during times like these, our job as investors is to evaluate what impact the conflict might have on the global economy. Also, the financial markets and then decide if we need to change the advice we give about portfolios.

There may be volatility as investors wait to learn more, but the actions taken thus far seem designed to avoid material escalation. The market reaction has also been muted as trading starts today.

This is not the first time geopolitical turmoil has been the catalyst for turbulence for investors. In the end, staying invested in a diversified, goals-aligned portfolio has benefited through countless geopolitical crises, wars, pandemics, and recessions—and we believe that should remain true.

Iran’s Measured Retaliation Against Israel

Iran carried out a major retaliatory drone and missile attack against Israel over the weekend. Almost all were intercepted before they reached Israeli airspace, with the joint help of the U.S., UK, France, and Jordan.

The event marks a clear escalation of tensions in the region. It’s worth noting that Iran’s attack seemed designed to avoid further escalation while still demonstrating its resolve. The White House and European officials have urged Israel to show restraint. President Biden has reportedly stressed to Israeli PM Netanyahu that the U.S. will not assist with or support any offensive operations against Iran.

The geopolitical backdrop remains uncertain and carries more risk than before, but there are arguments against a wider conflict so far.

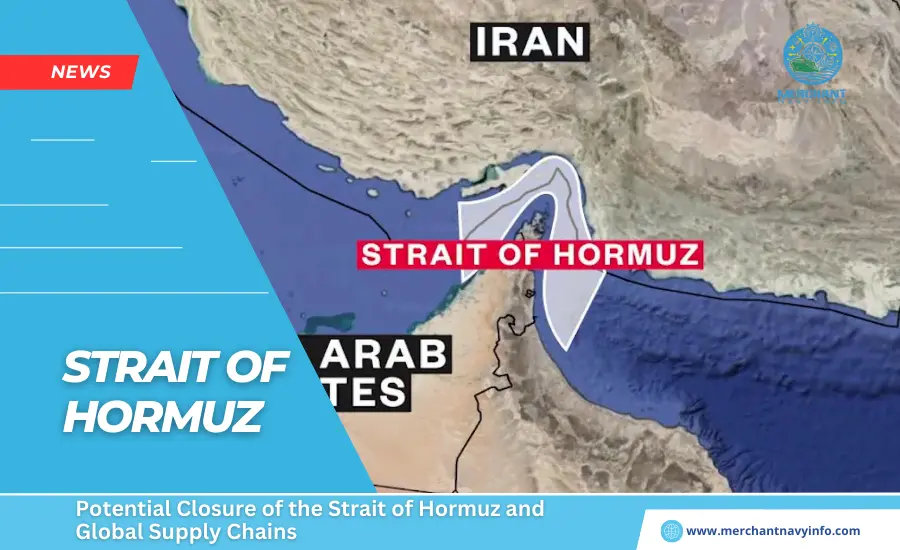

Investor Focus Shifts Back to Economy

Nerves seem tempered for now on Iran’s statement that the “matter can be concluded,” but the world is watching to see how Israel responds. Suppose Israel doesn’t escalate, and the conflict remains contained. In that case, global investors will likely revert to the status quo. The economic cycle is in the driver’s seat, and geopolitics is a tail risk. However, if the conflict escalates into one with a larger geo-economic footprint (particularly through the involvement of more parties or closure of the Strait of Hormuz), More careful analysis is required.

To do that, we are watching three main areas are:

1) Impact on natural resources.

The gist: Iran is a smaller oil supplier. However, the potential for conflict spillover into the broader region and disruption of significant transit routes like the Strait of Hormuz pose a greater risk. Oil prices will likely reflect some of these risks with a geopolitical risk premium in the coming months, but we’d need to see meaningful escalation to see a pronounced spike to 2022 highs of $125/barrel from today’s $90/barrel.

Today, Iran accounts for around 4% of global oil production. As a point of comparison, Russia’s share of global production was almost three times that as it began its war with Ukraine and with far more developed economies reliant on those imports.

However, two risks stand out:

- The risk of a broader conflict. The Middle East accounts for roughly a third of global oil production. Should others in the region start to take sides, the energy supply picture could look more difficult.

- The risk of transit disruption. Here, the Strait of Hormuz sees almost 20% of the global oil supply and a significant amount of all shipping volumes. Iran’s geographic proximity to the channel poses a risk of immobilizing supply with a global impact.

To us, both risks appear contained for now. The U.S. has been against an Israeli counteroffensive, which reduces the risk of retaliation and escalation. Iran’s reliance on the Strait of Hormuz also makes its closure seem less likely—with severe consequences for its already struggling economy, Arab Gulf states broadly, and China (Iran’s largest trading partner).

2) The effect on the economy – especially inflation.

The next logical question is what a surge in energy costs could mean for inflation. And with central bank rate cuts already being debated, what might that mean for monetary policy?

Drawing on our recent analysis of inflation, the pass-through effect of higher energy costs on consumer prices differs across regions. The potential impact appears less severe in North America – where economies are predominantly energy-independent today. Our analysis, which uses data from 2000, implies that a surge in oil prices to their $125/barrel peak would result in a less than 1%pt spike in “non-energy” inflation. Regarding growth, some comfort might also come from the fact that the U.S. is less energy-intensive than it used to be. As compared to the early 1970s, it now takes over 70% less oil to generate one unit of GDP. In Europe, the impact of inflation and growth would likely be greater.

Outside of energy prices, obstruction to global supply chains via the Strait of Hormuz could add pressure to goods prices (which have been deflating over the last year) as companies try to pass on higher input costs (like shipping and air cargo prices).

Central bankers must balance such upside inflation risks with the potential growth headwinds. That would be tricky to navigate, but as long as there is no genuine reversal of disinflationary trends, policymakers would not be forced to return to rate hikes.

3) The follow-through into price action.

So far, the market moves have been muted. That may be because media headlines were telegraphing a potential attack that started on Friday, with investors already gearing up. As Monday trading begins, oil prices have moved moderately lower off last week’s spike above $90/barrel, and bond yields are largely unchanged. European stocks have even opened in the green.

Outside of the immediate market reaction, it’s worth noting that the nations at the center of this weekend’s events represent a small proportion of the global stock market: Israeli shares account for just 0.18% of the MSCI All-Country World Index, and the Middle East as a whole is 1%. Disruption in these economies alone also helps earnings: S&P 500 companies derive just 0.2% of their revenues from Israel.

Investment considerations: Investors should consider and prepare for geopolitical threats, a key point in our CEO Jamie Dimon’s 2023 Annual Shareholder Letter. Already, economies are reorienting supply chains and increasing defense spending to bolster their security.

As we look forward, no one has a crystal ball. History has taught us a few lessons on navigating events such as these. Drawing on the seminal work of Michael Cembalest (AWM Chairman of Market & Investment Strategy). The business cycle mattered more for investors in the majority of the geopolitical events in post-war history he examined. That means that barring a major economic disruption or imbalance, as outlined above. Geopolitics’ effect on markets has tended to be short-lived.

The key message: Staying invested in a diversified, goals-aligned portfolio has paid off through countless geopolitical crises, wars, pandemics, and recessions. They will likely continue to do so.